Ministry of Finance

MOF consists of three directorates:

1. Finance

The Finance Directorate is responsible for:

The general management of all Government funds and the supervision of their correct use. Here, the financial interests of the state and other institutions, in which the state has a financial interest, are also monitored. The representation of the state in all cases in which it participates in the share capital of financial institutions is also monitored by this Directorate;

The supervision of state banks, as well as the public credit system and pawnshops, the levying and collection of stamp duty and other legally levied duties, the postal system, the national lotteries;

All matters relating to the state budget and general budgetary policy, as well as the accountability and accountability of state funds;

The general financial and monetary policy, insurance and the circulation of coins and notes;

Matters of foreign exchange – policy nature, all this in cooperation with the Ministry of Trade and Industry and the supervision of compliance with the foreign exchange regime regarding licenses for import and export of goods and services;

Taking out loans, issuing treasury bills, promissory notes, issuing state guarantees and investing or reinvesting government funds.

2. Taxation

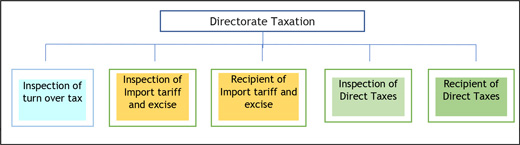

The Directorate Taxation is divided in:

Figure 3.4 Divisions Directorate Taxation (Source Mr.M.R Persad BBA; Hoofdlijnen Surinaams Belastingrecht)

In Suriname taxes are levied based on guidelines within the law. These are contained in various tax laws, such as Direct Taxes: Income Tax Act 1922, Wage Tax Act, Rent Value Tax Act 1955 and Property Tax Act 1944, the Collection Act (The Royal Decree of April 3, 1869) and the Surinamese Code of Civil Procedure. In the case of Indirect Taxation, these include the following: Import Tariffs Act 1996, Excise duties on, among others, alcoholic and alcohol-free beverages, Consumption Tax Act and Statistics Law. The Tax and Customs Administration is responsible for the implementation of these laws and has the task of levying and collecting taxes, such as Income Tax, so that the tax funds end up in the state treasury. The tax authorities also monitor compliance with the laws.

These two directorates are primarily involved in the extractive sector.

3.Development Planning and Development Financing

Based on the ministerial decision of May 2015, the directorate ‘Planning and Development Financing’ has been added to MOF with retroactive effect from September 2010. This department oversees medium and short-term planning as well as the recruitment and management of funds that are available for the implementation of development plans and projects through development partners and international financing institutions.