A summary of the results of the 2016 reconciliation for the mining company is set out in the next table:

Table 5.4 Summary reconciliation difference mining companies 2016

Timing differences RGM

This regard payment made by RGM on December 15, 2016, to NV1 based on amendment 2/2013 and letter of agreement/ 2016, amounting approximately USD 10 million, i.e. SRD 70,562 thousand. MOF has confirmed the receipt of this payment in favor of NV1 in January 2017.

1. Payment to NV1 by RGM

The following explanation is given by RGM regarding payments made to NV1:

RGM has reported all payments made to NV1, a Government owned Limited Liability Company, of which 98% of the shares belongs to the Government of Suriname and 2% to the NOB. The cooperation between RGM and NV1 takes place within the framework of the Saramacca Project. An Unincorporated Joint Venture (UJV) would be established, as laid down in the Second Amendment (2013) to the Mineral Agreement, in which NV1 will be a partner designated by the Republic of Suriname. In 2016 this arrangement took a turn as described beneath.

2. Acquisition of the Saramacca concession by RGM

The terms and conditions for the acquisition of the Saramacca Concession as agreed between RGM, the Republic of Suriname and NV1 are laid down in the Letter of Agreement (LOA) dated August 30, 2016, as amended on December 12, 2016 (1st Amendment LOA) and as further amended December 8, 2017 (2nd Amendment LOA). Based on those conditions it was agreed that NV1 would transfer 100% of the ownership of Saramacca right of exploration to RGM under the following terms:

- RGM has committed to contribute the Saramacca Concession to the Unincorporated Joint Venture subject to Section 8 and Section 9.5 of the LOA and in accordance with the Second Amendment of the Mineral Agreement dated June 6, 2013.

As far as the payments are concerned the following purchase price was agreed:

- Payment of the sum of USD 200,000 by RGM to the MOF/Government, upon execution of the LOA and the payment shall be considered as payment for i.e. the data package as mentioned in Section 5.1 of the Original LOA.

- Payment of the sum of USD 10 million by RGM to the MOF /Government, upon registration of the Notarial Deed transferring the Saramacca Right of Exploration from NV1 to RGM and delivery of all other consents and documentation necessary to make such transfer binding and effective under the laws of the Republic of Suriname;

- Transfer of 3,125 million IMG common shares to N.V. 1 in 3 tranches:

- First tranche of 1,041,667 IMG shares 12 months after the date of transfer of the Saramacca right of exploration from NV 1 to RGM;

- Second tranche of 1,041,667 IMG shares 24 months after the date of transfer of the Saramacca right of exploration from NV 1 to RGM; and

- Third and final tranche of 1,041,667 IMG shares 36 months after the date of transfer of the Saramacca right of exploration from N.V. 1 to RGM;

- Final payment regards the Adjustment Amount of maximum of USD 10 million subsequent to a NI 43101 compliant resource estimate for the Saramacca concession.

For the fiscal year 2016, the relevant payments to the Government are:

- USD 200,000 which was paid on August 31, 2016 upon execution of the Letter of Agreement dated August 30, 2016;

- The single payment of USD 10 million made on December 15, 2016 following transfer and registration of the Saramacca right of exploration from N.V.1 to RGM. This payment was received in 2017 by N.V.1 according to MOF.

On May 10, 2019, it is made public that the Saramacca deal regarding N.V.1 is terminated. (see

http://www.starnieuws.com/index.php/welcome/index/nieuws/)

Settlement differences

These differences regard a settlement of a claim against the Government regarding excess payment of income tax in previous years. Based on an agreement with the tax authority, RGM has deducted monthly a fixed amount of SRD 600 thousand of the monthly payment of wage tax.

Other differences

These differences regard differences between MOF and Grassalco, that are cleared and confirmed by MOF as a difference but is not settled with Grassalco yet. The Government has un-intentionally received in 2016 SRD 18,093 thousand on royalty fee that needed to be transferred to Grassalco, but this did not happen. On State level this does affect the amounts of payments received by the Government negatively, since the initial claims on Grassalco have been turned into debt to Grassalco due to this mistaken processing of the payments received in 2016.

Upon proposal of Grassalco to the Government, made in October 2018, the claim on the Government can partially be used as settlement for the outstanding balance of wage tax/social security premium and turnover tax. Grassalco did not pay wage tax/social security premium and turnover tax in 2016 regarding 2016 and prior years.

Uncleared differences

MOF reported the receipt of payments which are not reported by the companies. This can partly be the result that payments from the various tax- categories from a company can be mistakenly coded incorrectly; ultimately this has no effect on the total level of the total amount received.

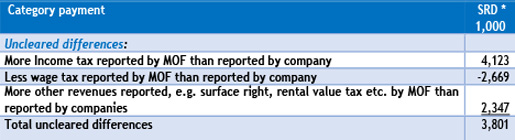

The following table provides a breakdown of the uncleared differences for the mining company in 2016:

Table 5.5 Uncleared differences mining companies

Within the materiality set for the 2016 reconciliation the amount of the total uncleared differences of SRD 3,801 thousand is not considered material and therefore no action is taken to clear these differences.

Payment in-kind

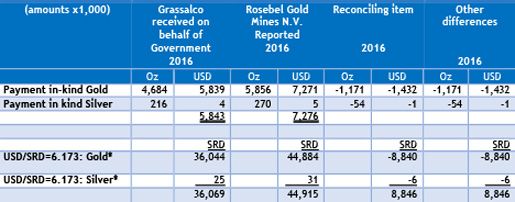

Table 5.6 Payment in-kind paid by RGM and received by Grassalco

*CBoS monthly average exchange rate for 2016

An excess royalty of 6.5% is paid by RGM to Grassalco on a quarterly basis in case the gold price increases above the threshold of US$ 425 per Troy Ounce.

The payment of the special royalty takes place in accordance with Article 20.11 of the Mineral Agreement (1994) and Article 4.2 of the First Amendment (2003). Regarding the payment in-kind 2% must be paid to Grassalco and 0.25% to SEMiF. The difference regarding payment in-kind between Grassalco and MOF has been partially cleared in 2018.

Shortly after the start of the commercial production of RGM in 2004, an arrangement was made between the State and Grassalco concerning the distribution of the monthly royalty proceeds from RGM, whereby the State would obtain 80% and Grassalco 20% of these royalty revenues. This arrangement is not available. However, in May 2018, the Minister of MONR provided a written response to the director of Grassalco that the 80/20% ratio regards the validation of the royalty payments, whereby 20% is paid out to Grassalco and 80% to the State of Suriname and that this arrangement will be effective from January 1, 2014. However, CBoS has applied this 80/20% ratio in 2016 based on the initial arrangement 2005 and as such no timing difference is reported due to the letter of the Minister of MONR from May 2018.

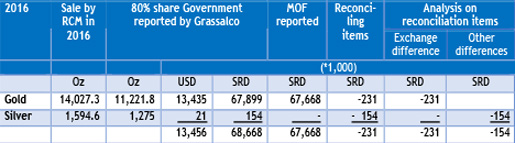

In 2016 sales of the gold and silver deposit at RCM Grassalco took place.

Grassalco and MOF reported the following sale of gold and silver in 2016:

Table 5.7 Sales of gold and silver in 2016 by Grassalco and reported by MOF

Small and medium scale mining right holders from SHMR

Though not material in the sense of payment flows to the Government, the collective reporting of the payment made by 15 associates of the SHMR is included in the EITI 2016 reporting.

Table 5.8 Collective Reporting 15 companies associated with SHMR and MOF

*see point C for explanation

The companies associated with the SHMR consider themselves vulnerable in exposing data of their companies and therefore agreed to participate as a collective of companies. The following is noted from our interview regarding the explanation of the financial data above:

- The members of this group did not commit to the M.O.U. on company level but as a collective of 15 out of the 40 companies associated with this platform, SHMR;

- The collective would not report their data based on a reporting template used by the other reporting companies and has proposed their own model- as above- which was approved by MSG;

- No financial statement of the companies would be provided if there were any.

The reconciliation of data collected was not possible since:

A: This collective did not provide:

- Evidence for the reported financial data nor a segmentation per participating company of the collective amounts reported;

- Other non-financial data such as beneficial ownership, agreements, ministerial orders as requested to the other companies according to the PBC list, nor data about CSR expenditure;

B: MOF could not report payments from the collective:

- Mainly since each company have a unique single tax identification number.

C*: MOF has reported an amount of SRD 93,081 thousand as royalty fee received from gold exporters, which could not be matched with this group of reporting entities since:

- The amount of royalty fee reported by MOF might include more small and medium size mining companies than those who have participated in this reporting cycle;

- Buyers of gold could also buy gold from the informal small-scale gold miners or other sources than these reporting members of this collective /the legal small and medium scale gold miners, hence this is causing a disruption in the flow of gold and the transparency of the royalty fee payment made by small and medium scale gold mining right holders, who are entitled to pay 2.75% royalty fee over their production;

- Small and medium scale miners do not pay their royalty fee obligation directly to the Government but pay 6.25% to the buyers of gold. As we were informed by SHMR, the sellers are not acknowledged by the buyers in an adequate, transparent and traceable manner for their payment of 6.25% cost including the 2.75% royalty fee. For this reason, they did not report the royalty fee payments because they cannot formally prove that they have fulfilled this obligation;

- Furthermore, we were informed that there might be more buyers than exporters of gold and therefore it is not clear which part of the volume of gold bought from this collective of mining right holders is included in the royalty fee reported by MOF;

- If buyers of gold do not sell all the gold bought from the small and medium gold miners than that part of the royalty fee withheld from these miners is not brought into scope. Based on decree SB 1989/40 and its amendment SB 2016/2, regarding decree Royalty small mining gold and building materials, the royalty withheld regarding the non-exported gold should be monthly declared at the tax authority and paid. This information is not included in the reporting since the buyers are not in the EITI-scope. This also indicates a distortion in the flow of royalty fee withheld from the gold miners and the royalty fee paid by the exporters and reported by MOF.