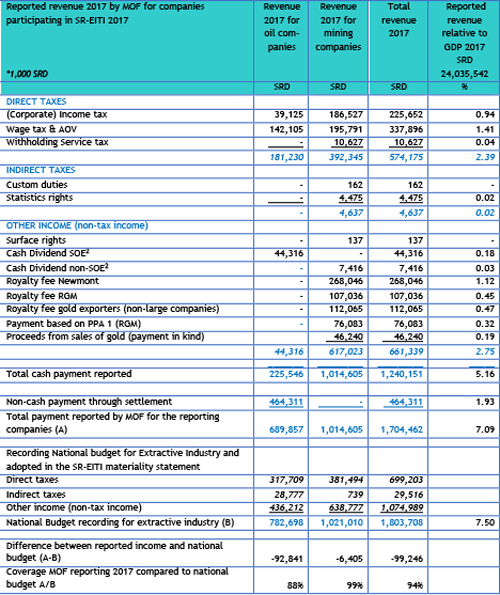

In accordance with the EITI standards of 2016 specific financial and non-financial data has been collected from reporting entities, Government institutes and ministries. In this section of the EITI report the data is reconciled and discrepancies, if any, have been further investigated and explained. In the following table the several revenue flows to MOF are presented for Oil and Mining, in total and relative to the GDP for 2017 of SRD 24,035,542 thousand (temporary GDP as reported on the website ABS: https://statistics-suriname.org/nl/

Table 5.1 Reported revenue streams by MOF related to the GDP 2017

1) The reported revenue -may- include cash and settlement of payments.

2) The cash dividend paid by Staatsolie (SOE) and RGM regards the fiscal year 2017 and 2016 and includes 25% dividend tax. On State level this does not affect the total amount of payments received.

In 2019 the reported income of the Government with respect to the fiscal years 2014 through 2018 has been adjusted for the following reasons:

- Data improvement (reclassification / identification / etc). After the process of reconciliation with the company directly (which MOF has carried out early in the year for the 2016 report);

- A closer inspection, data may have been identified as non-mining revenue; subsequently it has been concluded that it is an income as a mining company or vice versa;

- Data was recorded on another instrument /revenue line or with another mining company; the original recording was therefore incorrectly applied.

With reference to the narrative above the income of 2016 from the extractive industries has been adjusted from SRD 566 million to SRD 653 million. The 2016 reporting is not adjusted since the adjustments were partially due to the outcome of the SR-EITI 2016. The effect of the changes reflected in 2016 are explained as follows:

The reported GDP 2016 in the SR-EITI 2016 report amounting SRD 19,720,377 thousand is adjusted to SRD 19,489,361 thousand. The adjusted income of 2016 for the extractive industry, i.e. SRD 653.6 million is now calculated for 3.35% of the GDP, i.e. SRD 19,489.4 million. (Initially 2.86% in the SR-EITI 2016 report.)

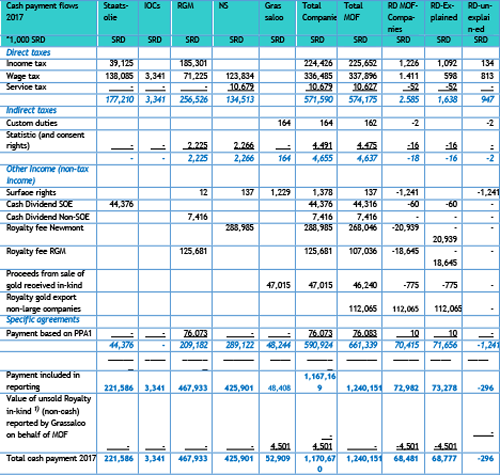

A breakdown of the total amounts received per sector by MOF in 2017, into amounts received per reporting company per sector, is included in table 5.2 and in the reconciliation, tables as set forth and detailed in the next 2 paragraphs. An explanation is provided regarding the reconciliation differences (RD) on company level in the payments received by MOF and the payments made by the mining and oil companies respectively.

The following cash payment flows from the reporting companies are included in the reconciliation:

Table 5.2 Overview reported payment by companies and by MOF 2017

1) This amount regards the USD value of the balance of unsold in-kind payments per December 31, 2017 and is reported on behalf of MOF by Grassalco. MOF did not report this as such.

Note:

- NV1 is not included as reporting entity.

- The payment flows regard the revenue streams from the oil and gold sector to the Government. The MSG has determined that these are the material flows for SR-EITI reporting for fiscal year 2017, whereas the payments of NV1 and special payments by Staatsolie are included for purpose of further disclosures of the financial relations with Government and SOEs.

Some income might not be considered material on a total income level, but companies and MOF have uploaded these payments, which therefore is included in the report for reasons of comparison.