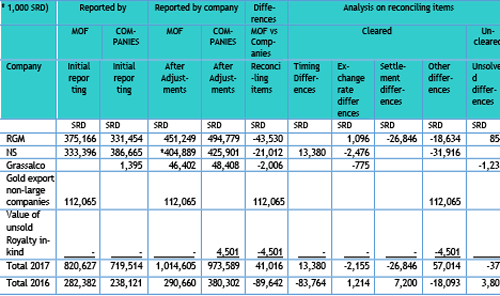

A summary of the results of the 2017 reconciliation for the mining company is set out in the next table:

Table 5.3 Summary reconciliation differences mining companies 2017

*) The reported revenue by MOF includes 4 reimbursements by Staatsolie of royalty received from NS from November 2016-February 2017.

Hereafter disclosure of the significant differences will be explained per company. Exchange differences are a result of differences in converted values by parties based on the exchange rate at the time of reporting and therefore, they are considered trivial and will not be disclosed.

Uncleared differences will be disclosed for amounts above SRD 1,000 thousand.

Differences RGM

Settlement differences

The reported settlement difference amounting to SRD 26,846 thousand regards the settlement within RGM of the payment of the 1st installment of the self-assessment provisional tax liability for 2016 with their remaining claim against the tax authority due to a carryforward fiscal loss (2011/2012).

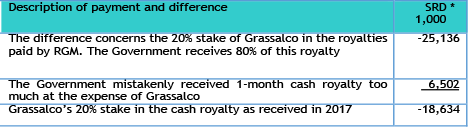

Other differences

These differences are explained as follows:

Table 5.4 Explanation other differences Grassalco

Differences NS

Timing differences/Other differences

With reference to the mineral agreement 2013, NS should transfer the royalty related to their gold production to MOF. But based on a temporary agreement between GOS and NS, NS has transferred to Staatsolie its monthly Royalty payment from November 2016 until March 2017.

In 2016 NS has paid to Staatsolie an amount of USD 1.8 million, which was received in 2017 by Staatsolie and transferred to MOF. This discrepancy of royalty fee was explained in 2016 as timing difference NS and in 2017 reported as timing difference for the other reporting entity. Furthermore, of the remaining 4 months of royalty received over the period December 2016- through March 2017, Staatsolie has reimbursed 3 months to GOS. The royalty fee over March 2017 is yet to be paid as of December 2017 to the Government and is recognized as a difference in the category ‘other differences’

Differences Grassalco

Uncleared difference

This difference refers to payment of surface right by Grassalco and at the Centrale Betaaldienst (Centrale payment office of the Government). Because the Centrale Betaaldienst reports and/or transfers the payments received over a period in its total, it is hardly possible to trace the transactions per creditor. Consequently, MOF could not identify the payments of surface right of Grassalco consisting of several small amounts. The difference remained uncleared and is considered not material for further exposé.

Difference gold export non-large companies

Other differences

These differences arise because exporters of gold bought gold produced by non-large companies.

The exporters pay effectively royalty on gold at the time the gold export is executed. These exporters are not a reporting group under the SR-EITI scope. As a result, these royalty revenues, directly associated with the extractive sector, are only reported by MOF and cannot be reconciled nor reviewed for validation purposes through data collection from, and reconciliation with the exporters. As opposed to SR-EITI report 2016, it has been concluded, in consultation with MSG and MOF, to include the proceeds in the reconciliation, by obtaining evidence from an external source regarding deposits from/payments of royalty by the gold exporters. Based on the credit notes from the CBoS (deposit per exporter), the full reported revenue for 2017 has been tested.

Work performed relates to comparison of detailed information of the reported Royalty fees by MOF with the underlying credit notes of the CBoS, which is the transfer of the royalty payments to the bank account of the Government/MOF.

No inconsistency has been noted between financial data provided by MOF and the underlying data from the CBoS. As such it is concluded that the reported revenue transactions are reflected properly.

However, no assurance is given regarding the completeness, or the accuracy of the payments made by the exporters, as this is not in the scope of this assignment.

Value of unsold Royalty in-kind

This income of the state relates to the final balance of the movements in the payment in kind received. The final balance is determined by the starting position of the in-kind payment as of January 1, 2017, the in-kind payment received and its sale in 2017. Only the unsold part of the in-kind payment is recognized here, since the proceeds of the sales are already included as income identified and reported by MOF and Grassalco.

The unsold royalty in-kind will be explained as follows:

- the payment in-kind received in 2017;

- the proceeds of the sale of payment in-kind in 2017;

- the unsold gold stock/payment in-kind as of December 31, 2017, taking into account the stock as of January 1, 2017.

The reconciliation differences will be explained.

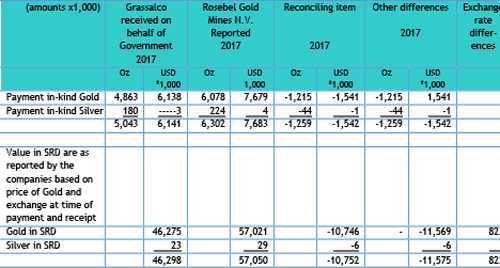

1. Payment in-kind received in 2017

The disclosure of the payment in-kind

Table 5.5 Payment in-kind paid by RGM and received by Grassalco

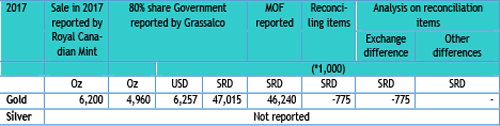

2. Proceeds of sales of -gold received as- payment in-kind in 2017

In 2017 sales of the gold and silver from Royal Canadian Mint deposit was initiated by Grassalco.

Grassalco and MOF reported the following proceeds from sale of gold and silver in 2017:

Table 5.6 Sales of gold and silver in 2017 by Grassalco and reported by MOF

3. Unsold gold/stock (payment in-kind) at Grassalco as of December 31, 2017

Table 5.7 Volume and value unsold gold (payment in-kind) in 2017 at Grassalco

Other differences (payment in-kind)

These differences arise from the mineral agreement 1994 and concern the royalty payment in-kind, special royalty to Grassalco. This royalty amounts to 2.25% of the refined production of RGM, of which 2% must be deposited into the pooling account of Grassalco by Royal Canadian Mint. The remainder in-kind payment of 0.25% is deposited on behalf of SEMiF on their account.

The Government share in these payments made to Grassalco are based on an agreement that was probably made at the end of 2004. Based on this agreement the GOS receives 80% of the royalty payments in cash and in-kind. Grassalco receives the remainder of 20%.

Since Grassalco is the legal owner of the pooling account and the gold, it manages the gold and movement in the pooling account which are reported in the statements of Royal Canadian Mint.

Given this course, only Grassalco can report this payment in kind, the changes and the stock as of December 31 of a year. Therefore, it can be concluded that this difference indicates a permanent reconciliation difference.

Conversely, the revenue from the sales of the gold received, if any, can be reported by MOF and Grassalco, as the revenue from the sales is deposited into the general account of MOF at CBoS. Based on the above 80/20% arrangement, CBoS makes a transfer to the bank account of MOF and Grassalco respectively. The sales of gold, a second stream of income of GOS, are explained above.

The amount of unsold gold (stock) as of December 31, 2017 is 597 ounces and the Government share is 478 ounces with a value of USD 748 thousand or SRD 4,501 thousand.

Small and medium scale mining right holders from SHMR

Though not material in the sense of payment flows to the Government, the collective reporting of the payments made by 15 associates of the SHMR is reported in SR-EITI 2017 as follow:

Table 5.8 Collective Reporting 15 companies associated with SHMR and MOF

*see point C for explanation

Regarding the companies associated with the SHMR and their concerns to expose their data individually, there has been no change. They have signed the M.O.U. as a collective for 2016 and 2017. They have reported their data of 2017 on the same bases and conditions, as set in 2016 which is based on:

- Their own model of reporting sheet as approved by the MSG;

- No detail reporting of the participating companies but as a whole of participating companies;

- No submitting of financial statements of the participating companies.

As was the case in 2016 the reconciliation of data 2017 was not possible since:

A: This collective did not provide:

- Evidence for the reported financial data nor a segmentation per participating company of the collective amounts reported;

- Other non-financial data such as beneficial ownership, agreements, ministerial orders as requested to the other companies according to the PBC list, nor data about CSR expenditure;

B: Due to the collective reporting of a group of companies, MOF was not required to report payments from the collective as this would have required the consent on an individual basis from all.

C*: MOF has reported an amount of SRD 112,065 thousand as royalty fee received from exports of gold from non-large companies, which could not be matched with reporting of the SHMR reporting group since:

- The amount of royalty fee reported by MOF might include more small and medium size mining companies than those who have participated in this reporting cycle;

- Buyers of gold could also buy gold from the informal small-scale gold miners or other sources than these reporting members of this collective /the legal small and medium scale gold miners, hence this is causing a disruption in the flow of gold and the transparency of the royalty fee payment made by small and medium scale gold mining right holders, who are entitled to pay 2.75% royalty fee over their production;

- Small and medium scale miners do not pay their royalty fee obligation directly to the Government, but they pay 6.25% to the buyers of gold. As we were informed by SHMR, the sellers are not acknowledged by the buyers in an adequate, transparent and traceable manner for their payment of 6.25% cost including the 2.75% royalty fee. For this reason, they did not report the royalty fee payments because they cannot formally prove that they have fulfilled this obligation;

- SHMR-companies reported a calculated amount of royalty fee payment amounting SRD 25 thousand, which is only for informational purpose, since they do not pay royalty separately. On the other side we could not validate this calculation due to lack of evidence provided. Regardless of the validity of the SHMR-report, there is a large discrepancy between the reported royalty fee by MOF and by SHMR. Partly due to being unable to validate the royalty fee report from SHMR as well as other payment flows, the SHMR report was not included in the reconciliation 2017.